Startup funding, or capital raising, is a relatively complicated process, which requires beginners to spend quite a deal of time reading to really understand. The reality television series Shark Tank is a good place where you can see how startup financing works, but even this show sometimes confuses us with a bunch of technical jargon, such as valuation, preferred stock, or equity. And because of that, we will provide you with a couple of articles that present the basics of convertible notes Startup Funding. Starting with a commonly recommended fundraising instrument called convertible notes.

Now, before getting to know what convertible notes mean, we must first understand the term stock.

Shares of Stock, Valuation, and Other Basic Concepts

The term stock represents the ownership in a company, and it is measured by an indivisible unit of capital called a share. The person who owns shares is called a shareholder or stockholder. Share of stock is the basis to determine how much the shareholders claim on the company distributed profits (dividend) and how powerful their voting is on certain key company decisions. In other words, the more shares a shareholder has, the more percentage of ownership he has; he will receive more profits, and his opinion always counts. He should have some kind of stock analyzer tool that not only displays data but also assists you in interpreting it.

The most obvious way to acquire ownership of a company is cash investment. But also, in some companies, if you are a hard-working employee who contributes significantly to the company’s growth, you may be rewarded with a certain amount of shares.

FURTHER READING: |

1. 6 Key SAAS Metrics Every Tech Startup Must Know |

2. Software Project Management Plan: Steps and Tips |

3. 4 Convertible Notes Startup Funding that You Should Know |

1. How many shares does an investor get in exchange for their investment?

To give you a clearer picture, let’s say there’s a company called X, founded by A and B. Because A and B come up with the startup idea together, and they have put a pretty similar amount of money and effort into building up the company, they are thus equal partners. So when startup X is incorporated with a total capital of $1M, and 1 million shares of stock are issued, then each partner will own 500,000 shares of stock, reflecting 50% ownership of the company capital. You might wonder why there is such a number as “1 million shares”. Why wouldn’t it be “1 hundred” or “1 thousand”. Well, we will discuss this later in this article.

Recommended reading: Lifestyle Startup Ideas for 2022

Most startups are incorporated as Delaware C-Corporations, and it’s the legal structure that is most familiar to investors, easy to set up, easy to manage, and very tax-friendly.

So, after a while, company X starts generating sales, and things are going well. Because there are a lot of customers coming, but the existing amount of capital is not enough for the company to accelerate its growth, A and B decide to begin raising capital, or startup funding.

Now if there’s an investor C coming and offering $500,000, which is equal to the amount of money that A and B had when they started the company, does that grant C the same percentage of ownership as A and B, resulting in each shareholder owning 33.33% of stock?

No, it doesn’t.

Because how much stock an investor gets with a certain amount of cash investment depends on how much the company is worth at the time of investment. And it’s the founders, A, and B, who will determine how much their company is worth.

2. What is ‘valuation’ in startup funding?

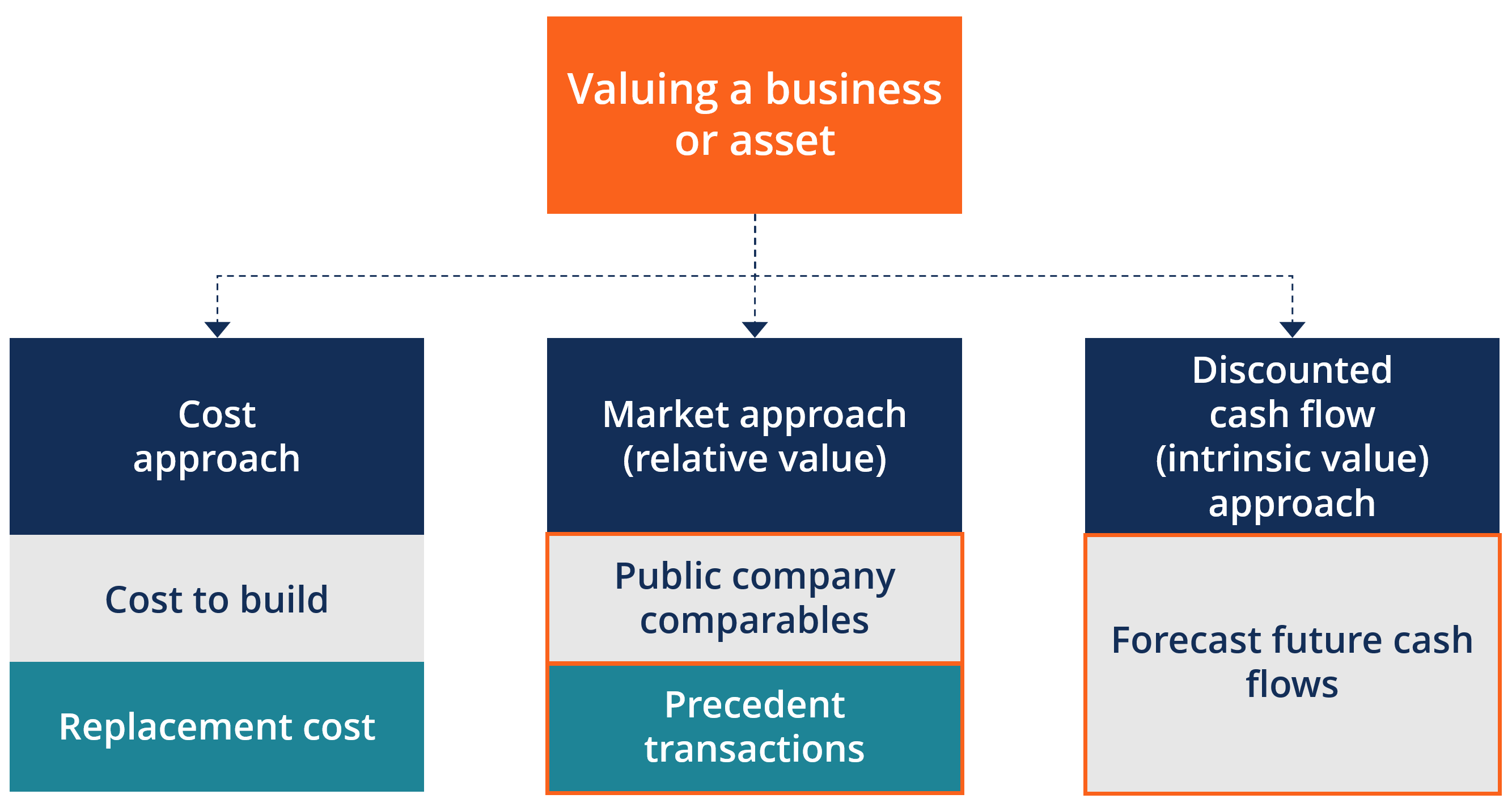

Although all business owners expect to have the highest company value possible, the valuation process must be based on a painstaking calculation, pulling together several factors including the annual revenue, cost of goods sold (COGS), profit, and margin (margin = 100*profit/revenue). These numbers demonstrate the company’s traction. The term traction refers to the progress of a start-up company and the momentum it gains as the business grows. There is no one way to measure traction; however, companies usually rely on customer response and revenue as indicators of their success. Traction is always the heart of every startup pitch deck.

Recommended reading: How to Create Startup Funding Pitch Deck?

Let’s say, if company X has already revenue of $10,000/mo, or $120,000/year, and the customer subscription grows fast, then the company’s value might be one or two times this number. In other words, if $240,000 is the worth of the company that both founders agree upon, then with $250,000, you can totally buy it (as long as the founders are willing to sell it).

But valuation is also determined by other variables, and these variables depend on the industry your company is in.

2. For example

One distinctive feature of biotech startups is that they often call for investment when their products are still in the research and development (R&D) process. And venture capitalists must be ready to accept that technical kind of risk. Tech startups, on the other hand, often deal with business risk, meaning the focus of investors is how the market responds to the products.

And there’s one unique thing about tech startups that makes valuation difficult: Tech startups are the scalable startup type, so nobody can tell exactly how big and how fast they can grow. Take Uber for example. In their first startup funding round, they only called for $500,000, but now their business is worth more than $80B. In addition to this tremendous scale potential, tech startups also have fantastic margins, which means they require very little COGS. A software product or a web app might serve millions of users worldwide and require just a small number of staff for operating. Think of Instagram. When they reached 300 million users, there were only 13 people on their team, and they have very few physical assets. So, there are other variables needed for tech startup valuation, such as:

- The addressable market size: So, how many customers are there for the company to serve, and how much would they be willing to pay for this product or service?

- The technology variable: Is there a unique piece of tech that nobody else has, or that optimizes a process drastically?

- Potential margins: How much does it cost me to serve an additional customer?

4. The market today

An average valuation in Silicon Valley for a tech company would be around a $4M pre-money valuation. Now if our company X has a value of $4M, then each share of X is worth $4. Four times higher than the moment when the company was founded by A and B. And thus, if C offers $500,000, he can only get 125,000 shares of stock.

But this number of shares is not transferred from that of A or B. Rather, the company will issue extra shares to investors like C. So, the total number of shares of company X after the investment is 1,000,000 + 125,000 = 1,125,000. And as a result, A and B now get 500,000/1,125,000*100% = 44,44% for each, and C will get 11.12%. Of course, the number is rounded. But even 0,01% of the equity stake in companies like Uber could be $8M, which is why we have such a number of 1 million shares as discussed above. This number should be big enough so that even when it is divided. The loss of the stakeholders is at its minimum. And with investment from C, the company’s post-money valuation reaches $4.5M.

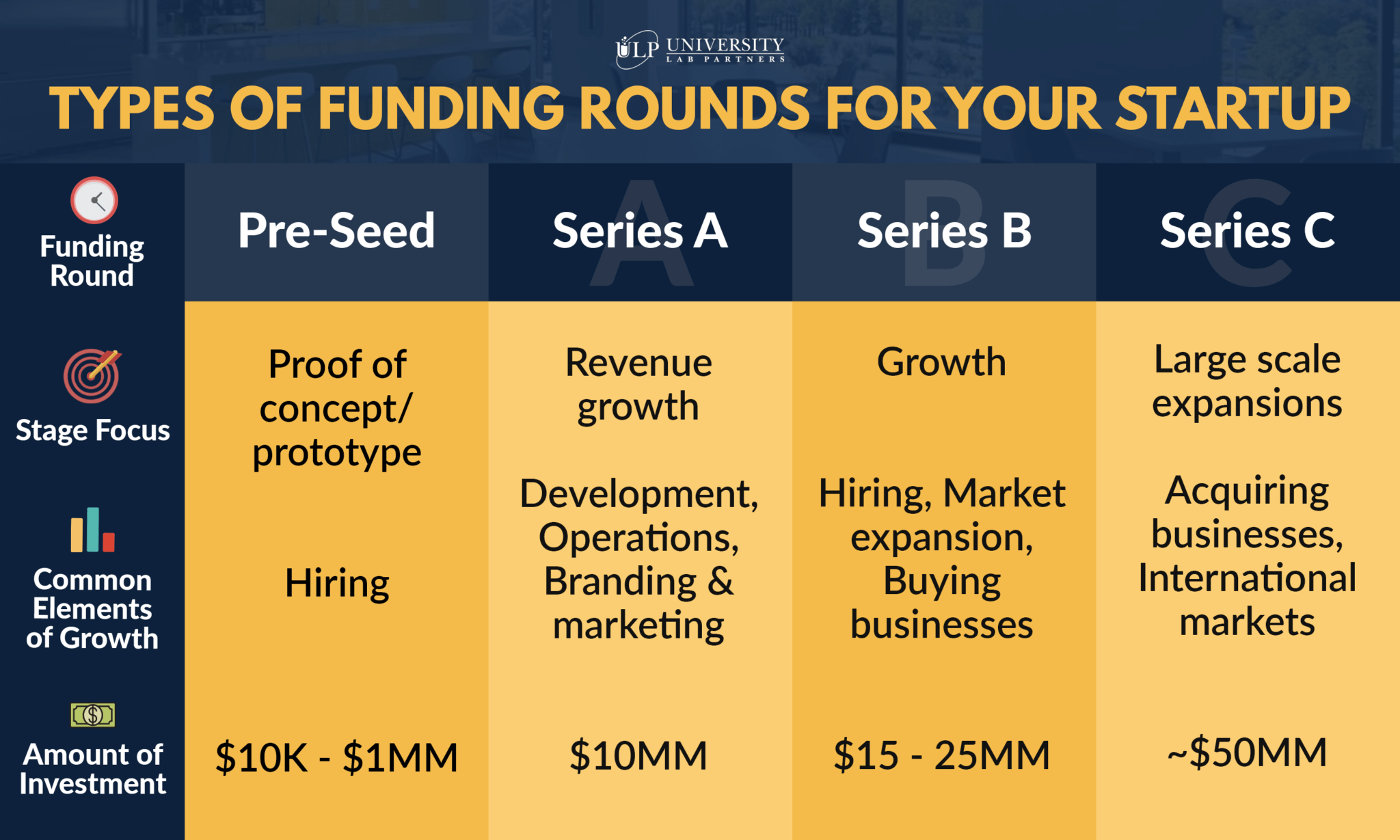

There might be several rounds of startup funding. After each round, the company’s value will increase. Zoom, the company selling video conferencing apps, for instance, in their Series D funding, Zoom received $100M and finally reached a $1B valuation to become a unicorn.

5. Why voting power matters

As mentioned earlier, the stock you own influences your voting power on the company’s key decisions. This is important in that if the company goes bankrupt and needs to liquidate its assets. The shareholder who has the largest proportion of ownership will decide who will receive the money first. This is often agreed on in the price round.

The stock also determines how the board of directors (BOD) looks. All the decisions, such as mergers and acquisitions, must be negotiated within the BOD, which is why investors spend lots of money because they want to have a seat in the BOD.

Typically it takes around 6 months to go from the talk “okay, I will invest” to the real money investment. And it requires a large amount of money for hiring lawyers and paperwork. But because most startups do not have 6 months, so they need to turn to another solution called a convertible note.

The 4 Convertible Notes Startup Funding

Technically, convertible notes are just like typical loans, but instead of using physical assets like real estate for collateral. Startups use shares of stock at a certain future valuation for the collateral. With convertible notes, investors want to say: “Now, I give you my money. Then after one year or so, we need to have some numbers to start a traditional funding round”. In other words, a convertible note is an instrument that “postpones” the valuation discussion. It allows the startup and the investor to move on to the investment more quickly. With fewer negotiations and fewer expenses on complicated and costly paperwork.

As discussed earlier, valuation is not easy at all because there are lots of uncertain variables with very limited data. So even though investors believe in the company’s potential to some extent. They want to make sure that they are not going to lose. That’s why there are a number of terms in the convertible notes that guarantee their safety.

1. Interest rate and discount

The convertible note always goes with an interest rate (typically 5-6%) and a discount rate (typically 10-25%), which is based on the valuation of the new investor.

For example, A and B receive money from C on a convertible note with an interest rate of 5% and a discount rate of 20%. With this investment, the company grows as expected. And next year, they intend to call for more money from investor D who is willing to invest $1M at the pre-money valuation of $4M. With this new investment, the convertible note is triggered.

Because C joined 1 year earlier than D, C receives $25,000 of interest. And C’s principal amount of loan plus accrued interest ($500,000 + $25,000 = $525,000) will be converted into shares at the valuation of $4M (20% of the post-money valuation after D’s investment, $5M). Then the division of stock in the company goes like this:

A and B have 36.8% for each. D has 9.7%, and C has 16.7%.

2. Valuation cap

Now, what if the company scales really fast? Within just a few years, the company found a new investor at a pre-money valuation of $50M. Even with a 20% of discount, C will only receive 1.5% of the stock ($525,000/$40M). So C’s risk/upside tradeoff C could not compensate for this business. That’s why in the convertible note, there’s also another term called valuation cap. It is the maximum valuation that the convertible note is triggered.

Provided that in our example, the agreed cap is $7M. Then if there is another investor joining at the post-money valuation of $50M. The valuation at which C’s money is converted is still $7M. Resulting in a 6 times higher paper return on C’s investment. Not bad at all.

This mechanism also applies to the case when the startup is acquired by a larger enterprise. When the convertible note is still withstanding, it will be triggered in this acquisition.

3. Maturity date

How about the case when company X doesn’t grow? If A and B do not succeed in the next round of startup funding, can C get his money back? In this case, there’s another term called the maturity date, which is the date when the loan will be converted into shares at the valuation cap, or C could ask for convertible note payback, given that the company is able to pay back. A and B may also choose payback if they think the conversion at the valuation cap is too much.

Now if the company cannot pay back, and the investor executes them, then they need to file for bankruptcy. The investor will lose most or all of his money because the company has no assets for collateral.

4. Repayment schedule

If company X doesn’t grow fast, but still is able to generate a revenue of $500,000/year, then there are two scenarios that might happen:

- The maturity date will be extended, and the investor will continue to receive interest. This solution gives the company time to accelerate growth and prepare for the next startup funding round.

- The company will enter a repayment schedule. Now, the company will not pay back at once, but in several installments. By doing so, the company will still have enough money for running the business.

All in all, a convertible note is a loan with an interest rate, discount rate, valuation cap, and maturity date. It can be triggered or executed. But the ideal scenario is that the company has the next funding round or is acquired by another company.

KISS (Keep It Simple Security) and SAFE (Simple Agreement for Future Equity) are two commonly used convertible note templates that you can take advantage of for raising capital and cutting extra costs for paperwork.

We at Designveloper hope that this article can help you know what exactly “convertible notes startup funding” is!

Read more topics