Fintech Cybersecurity: Security Measures for Robust Fintech App Development

May 28, 2024

Fintech cybersecurity, which deal with huge amounts of private financial data and a huge number of transactions every day, are vulnerable to many complex threats. It’s impossible to say enough about how important safety is in this field. Trust, honesty, and following the rules all depend on strong security measures, which are what keep fintech businesses going. To protect data, maintain customers’ trust, keep hackers away, and meet strict legal requirements, it’s important to understand and reduce the inherent risks.

This piece goes into detail about the many security problems that fintech apps have and the strong steps that developers must take to make sure their apps are always safe.

Importance of Cybersecurity in Fintech

These are the reasons why cybersecurity is crucial in the fintech sector:

- Data Protection: Fintech holds vast amounts of sensitive financial data. Without robust cybersecurity, this data is vulnerable to theft and misuse.

- Customer Trust: Cybersecurity safeguards your customer’s trust. If their data is compromised, they’ll lose faith in your app and take their business elsewhere.

- Target for Hackers: Fintech is a prime target for cybercriminals due to its valuable information. Strong cybersecurity measures deter these threats.

- Regulatory Compliance: Cybersecurity helps you meet regulatory requirements. Breaches can lead to hefty fines and legal ramifications.

1. The Risks in Fintech Security

To safeguard your fintech app from potential threats, it’s crucial to understand the inherent risks in fintech security such as identity thefts, DDoS and phishing attacks, and integration loopholes.

- Identity thefts can lead to unauthorized access to sensitive customer information.

- DDoS attacks aim to overwhelm your app with traffic, causing it to crash and leaving it vulnerable to further attacks.

- Phishing scams trick users into revealing their personal details, potentially compromising the security of your app.

- Integration loopholes can occur when your app is integrated with other systems, creating potential entry points for hackers.

2. Addressing Fintech App Security Risks

Here are four key risks you need to address:

1. Data breaches

Cybercriminals are always on the lookout for vulnerabilities they can exploit to steal sensitive data. Ensure your app has foolproof data protection measures.

2. Phishing attacks

These deceptive practices trick users into revealing sensitive info. Protect your users with proactive measures.

3. API security

Faulty APIs can expose your app to attacks. Regularly check your APIs for potential weaknesses.

4. Third-party risks

Many fintech apps rely on third-party services which can introduce risks. Make sure these are thoroughly vetted.

Challenges of Non-Uniform App Ownership

When developing a fintech app, navigating the complexities of non-uniform app ownership can pose significant security challenges.

Multiple owners of an app can introduce inconsistencies, miscommunications, and errors that give hackers an easy in. It’s like playing a game of telephone – the more people involved, the more likely the message gets distorted.

To tackle this challenge, it’s crucial to establish clear roles and access rights for each owner. You can’t leave it to chance or goodwill. It has to be a formal process, implemented right from the start.

It’s also necessary to ensure each owner understands the norms and standards of data possession. Ignorance isn’t bliss in this case; it’s a security risk.

Furthermore, you need reliable mechanisms for managing data and its changes. This means not only technical solutions but also legal processes to handle responsibilities and liabilities. You must be aware of the potential legal implications of any missteps.

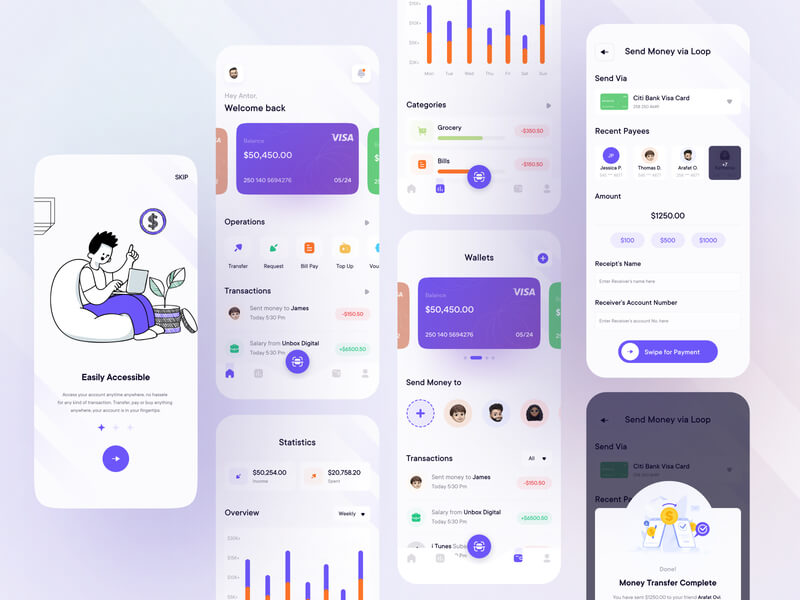

Secure Fintech App Development Practices

To secure your fintech software development, you must adopt these practices right from the start.

- Begin with a secure app architecture and use secure coding practices to prevent vulnerabilities.

- Keep track of metadata and use role-based access control to ensure data access is restricted to authorized personnel only.

- Regular security audits are crucial to identify and fix security gaps in a timely manner.

- Encryption of sensitive data and implementation of multi-factor authentication can significantly bolster your app’s security.

- Ensure your app complies with all pertinent regulations. Training your team on cybersecurity awareness can further enhance overall security.

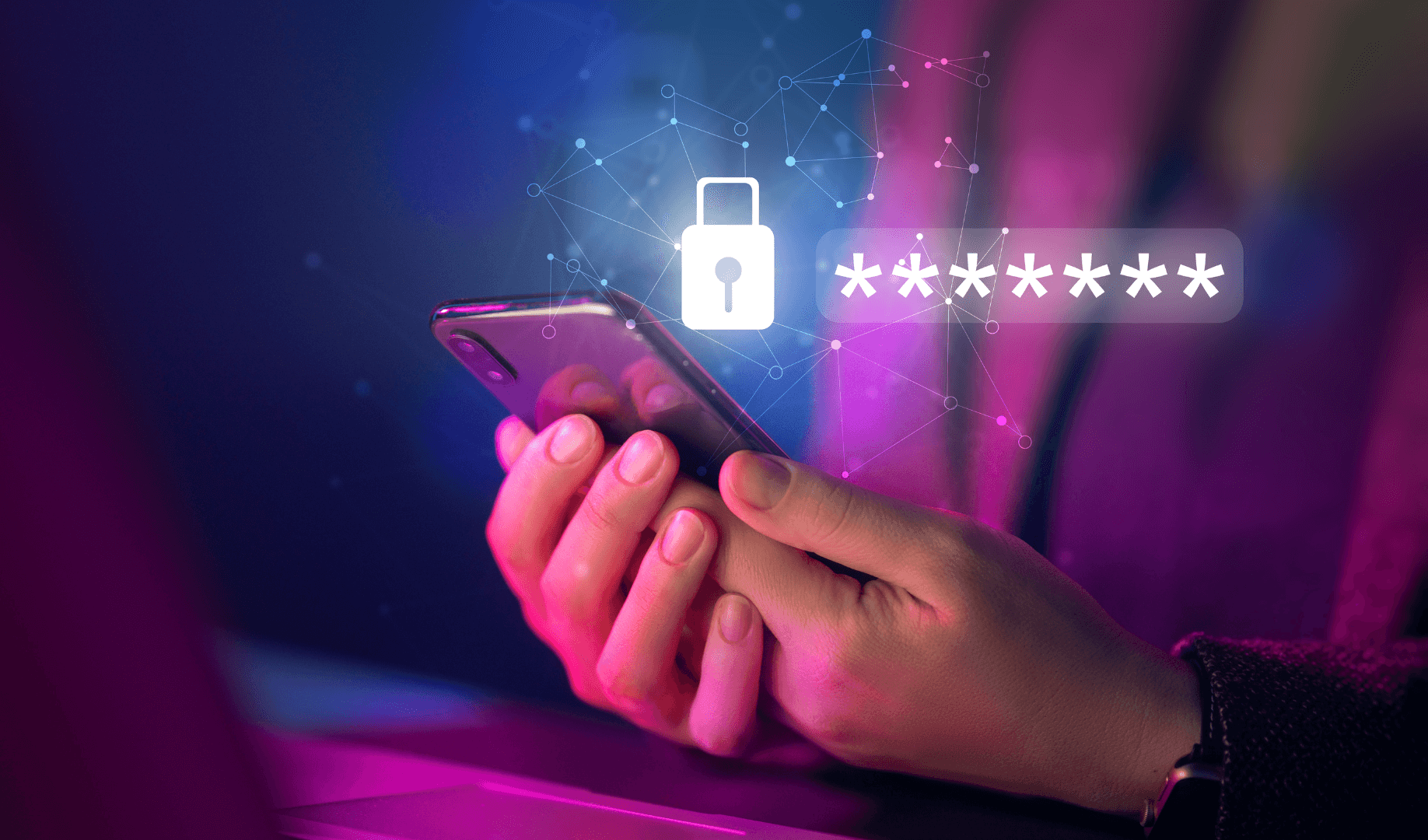

Implementing Encryption and Multi-factor Authentication

Encryption, using algorithms like AES and RSA, makes your data unreadable to unauthorized users. It’s crucial to encrypt not just data at rest, but also data in transit, ensuring full coverage protection.

Multi-factor authentication, on the other hand, adds another layer of security. Instead of relying solely on passwords, you’re integrating multiple verification steps like OTP, biometrics, or security questions. This makes it tougher for cybercriminals to gain access even if they crack one security layer.

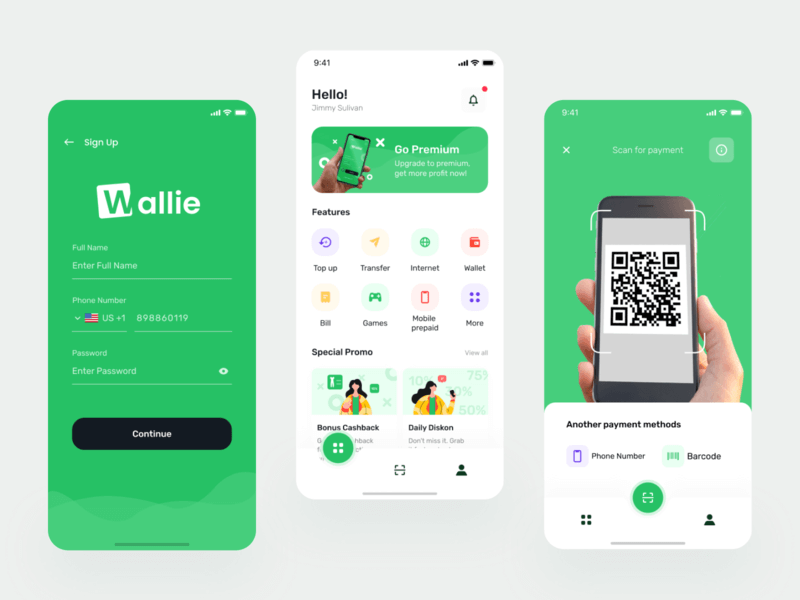

External Software and Fintech Apps

Fintech apps often interact with external software, opening up additional avenues for potential security threats. You’re not just dealing with your own app’s security, but also the security of these external platforms. In this interconnected world, a weak link can compromise the whole chain.

So, when integrating external software:

- Thoroughly vet the security protocols of the external platform.

- Regularly update APIs to avoid outdated security measures.

- Set up firewalls and monitor traffic between your app and the external software.

- Use secure, encrypted communication channels.

The Perils of Data Storage

Storing user data in fintech apps is fraught with risks and potential pitfalls. If handled poorly, it can lead to financial losses, loss of customer trust, and even legal issues.

If you’re a developer, you need to be aware of several key issues:

- The risk of data breaches: These can result in unauthorized access to sensitive financial information, causing major damage.

- Compliance with regulations: Failing to comply with data storage regulations can result in hefty fines and penalties.

- Data corruption: This can lead to loss of crucial data, impacting your app’s functionality and user experience.

- Redundant data: Unnecessary data makes your app slow and less efficient.

- Data loss: Without proper backup mechanisms, data loss can be disastrous for your users and your business.

You must adopt robust data storage and management practices. These include regular data backups, encryption, data minimization, and adherence to regulatory standards.

In doing so, you’ll not only protect your app and its users but also build trust with your users, a crucial component for any successful fintech app.

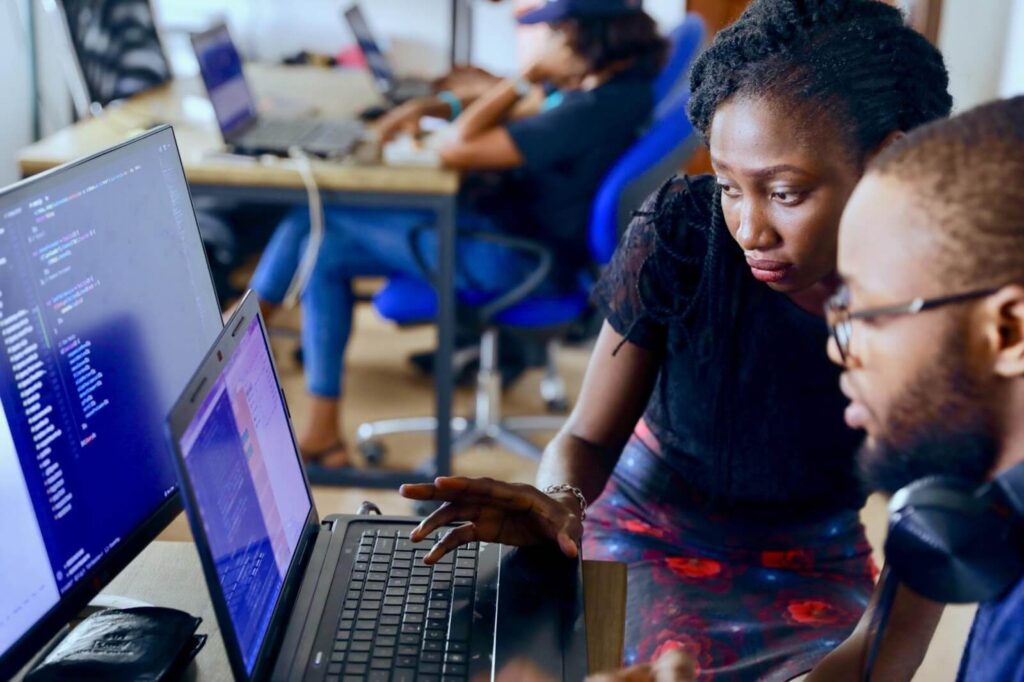

Integral Coding Practices for Security

Your code is the backbone of your app. It’s where the magic happens, but it’s also where vulnerabilities can creep in. Therefore, it’s crucial to incorporate secure coding practices from the get-go.

Start by choosing a technology stack with built-in security mechanisms. This safeguards your app even when you’re focusing on other aspects of development. Always remember to keep the code flexible. You’ll want to respond swiftly to potential security threats, and rigid code could slow you down.

Don’t forget about code obfuscation. By making your code hard to analyze, you’ll discourage hackers and slow down cloning attempts.

Encryption is another must-have. Using strong encryption algorithms like AES or RSA, you can safeguard your users’ data both at rest and in transit.

The Bottom Line

Strong cybersecurity measures are essential for keeping private user data safe, keeping customers’ trust, and following the rules. Not only do developers have to deal with common threats like phishing attacks, data breaches, and third-party risks, but they also have to keep an eye out for newer, more complex threats. If you want to build a safe fintech environment, you have to follow best practices for making secure apps, use encryption and multi-factor authentication, and store data correctly.

As a Designveloper with a focus on cybersecurity in fintech, I understand the critical importance of protecting financial data in today’s digital landscape. The rapid evolution of technology has undoubtedly enhanced convenience and accessibility in financial services, but it has also brought about new challenges and risks, particularly in terms of cybersecurity.

Fintech companies are at the forefront of innovation, offering innovative solutions that revolutionize how we manage and transact money. However, with innovation comes the responsibility to safeguard sensitive financial information from cyber threats. The consequences of a security breach in the fintech sector can be severe, not only resulting in financial losses but also damaging trust and credibility among users.

Read more topics